Trading apps in the comparison test: trade stocks and ETFs via app

Everything is getting more expensive, only your salary hasn't changed for years? A pretty bad idea is to just park the cash on the account. Inflation and negative interest rates are practically melting it away like the spring sun melting the last snow. But there is an easy way to get more out of your money: trading apps are the simple and inexpensive way to trade stocks and ETFs. We present 5 neobrokers.

Saving used to be easier: Even those who didn't bother and left the money in their checking account increased it - at least to a small extent. Fixed-term deposit accounts have thrown off a little more. Those who thought long-term had a home savings contract and hip business administration students immediately invested their student loans in shares. Times have changed: Leaving the money in the checking account is not advisable, keyword negative interest. If you are smart, you invest: The return opportunities are simply better with shares and ETFs (exchange-traded funds). And while trading used to require a sizable budget and know-how, today anyone can. Technology helps with that.

Trade stocks and ETFs with apps

With easy-to-use trading apps, anyone can now buy and sell stocks and funds at low cost. You don't have to be a financial expert or follow stock market news day and night. Of course you can also use a depot at the house bank, but that is really expensive in comparison. We present 5 trading apps that, as so-called neo-brokers, want to make stock exchange trading almost free of charge.

Table: 5 neobrokers at a glance

Bitpanda Finanzen.net Zero Justtrade Scalable Capital Free Broker Trade Republic Provider Bitpanda GmbH Finanzen.net Zero GmgH JT Technologies GmbH Scalable Capital GmbH Trade Republic Bank GmbH Registered office Austria Germany Germany Germany Germany Trading places LS Exchange Gettex LS Exchange, Quotrix, Tradegate Exchange Gettex, Xetra LS Exchange Payment options SEPA transfer, credit cards, Giropay, Sofortüberweisung SEPA transfer SEPA transfer SEPA transfer SEPA transfer, credit cards, Google Pay Annual deposit fee none none none none none Order fee none none (from 500 euros order), otherwise 1 euro none , but minimum order 500 euros none (from 250 euros via Gettex), 99 cents (otherwise at Gettex), 3.99 euros (via Xetra plus 0.01 percent of the volume) 1 euro costs for savings plans none, minimum deposit 25 euros per month none None, minimum deposit EUR 25 per month none none, minimum deposit EUR 10 per month Negative interest none none 0.5% from 5,000 Euro none none Info & Download bitpanda.com/de finanzen.net/zero justtrade.com de.scalable.capital traderepublic.com/de-deBitpanda: focus on crypto trading

Bitpanda (to the provider) has been on the market for 8 years and is based in Vienna, but stock trading has only been possible with the app for about a year. The focus was and is clearly on investments in cryptocurrencies. Bitpanda is now cleverly combining this with precious metals and stocks as well as ETFs. So if you are considering investing your money in different areas, Bitpanda could be something for you.

App and getting started: The app is easy to use and getting started without detours. First create an account, then set security questions and go through verification. There is a video identification process in the app for this. After that you can deposit money and start trading stocks or investing in cryptocurrencies. Payment is made via SEPA transfer, but alternatively credit card, Giropay or Sofortüberweisung are also available, but fees are then due. Offer and prices: You can really let off steam when it comes to cryptocurrencies at Bitpanda, where over 100 currencies are available. When it comes to precious metals, there are gold, silver, palladium and platinum to choose from. Shares and ETFs are still under construction compared to the other providers, but there are around 850 shares and 150 ETFs in total, and share and ETF savings plans are also possible. There are no custody or order fees, and you don't have to worry about negative interest either. You can invest from 1 euro, with savings plans it must be at least 25 euros per month. The spread is 0.5% during trading hours, but it can be up to 3% off the floor. Special features and extras: Cryptocurrencies are in Bitpanda's genes, but the combination with precious metals and stocks as well as ETFs offers an interesting mix. Bitpanda particularly emphasizes the opportunity to invest in partial shares, for example to secure a small piece of Tesla or Apple from 1 euro, even if the budget is tiny. This is done via so-called derivative contracts. You don't buy the shares yourself, Bitpanda does that. This post explains the idea in detail.Conclusion: Stocks and ETFs are still relatively new at Bitpanda, so the selection is even clearer compared to the competition. You can get in from 1 euro, but you don't buy real shares, you are involved via derivative contracts. ETF savings plans are feasible from 25 euros per month, a cost document (PDF) is available for the calculated spreads.

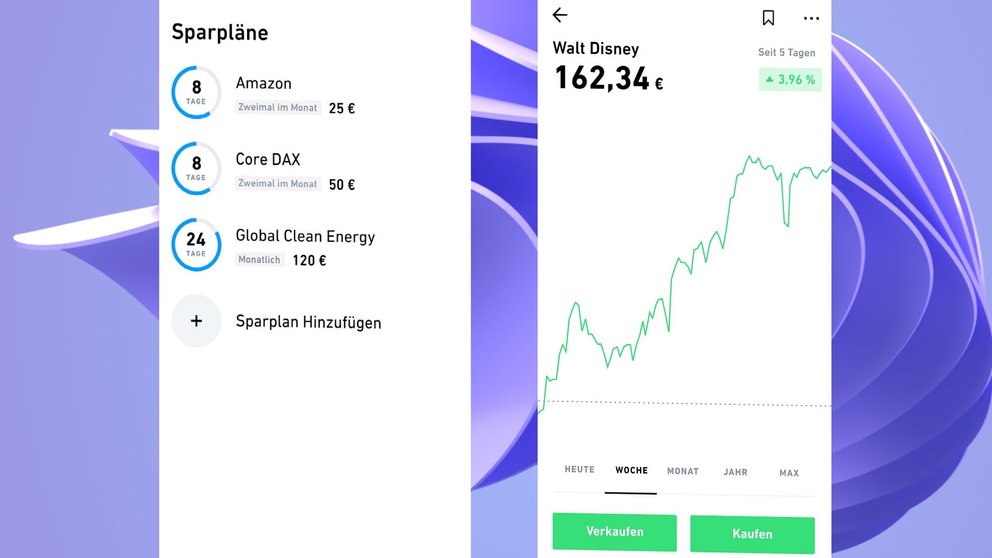

Finanzen.net Zero: App for minimalists

The "zero" in the name already indicates that there will not be many fees here. You don't trade in Finanzen.net Zero (to the provider) for free, but the costs are manageable.

App and entry: As with all neo-brokers, the entry works without any problems, but the app does not burn off any fireworks of features, on the contrary, it is kept rather minimalistic. That doesn't have to be bad, the focus is on buying and selling, but experienced investors might miss one or the other feature. Offer and prices: The offer is absolutely sufficient for normal users, there are about 6,000 stocks, plus around 1,800 ETFs and managed funds. There are also over 400 ETF savings plans to choose from. There is no annual fee, and orders are also executed free of charge. But there is one important detail. Anyone who buys less than 500 euros pays a fee of 1 euro, but that should be manageable. The ETF savings plans are also executed free of charge. Incidentally, there are no negative interest rates or custody fees. Special features and extras: In addition to shares or ETFs, you can also trade cryptocurrencies.Conclusion: Finanzen.net Zero is a good choice for beginners who prefer a clear app that is reduced to the essentials.

Justtrade: Large selection with stumbling blocks

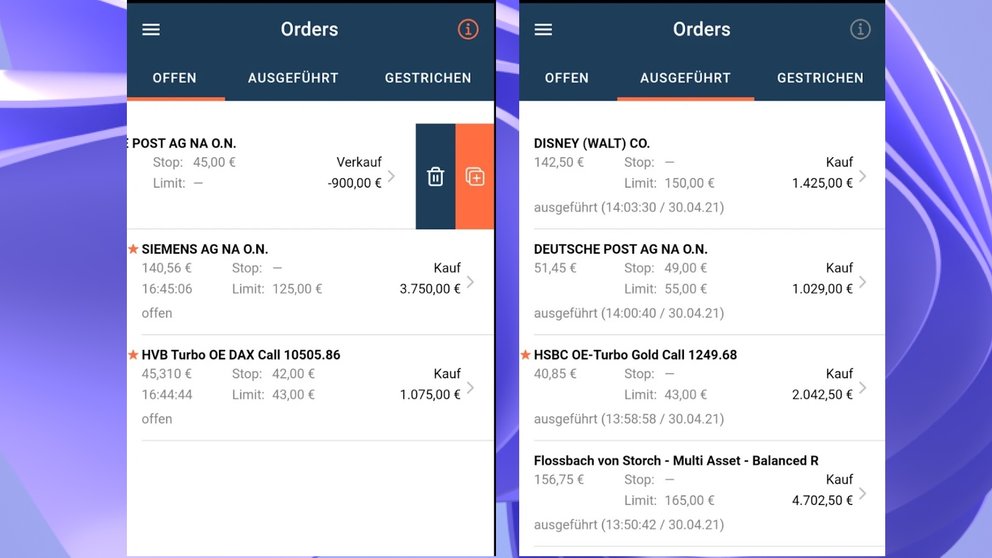

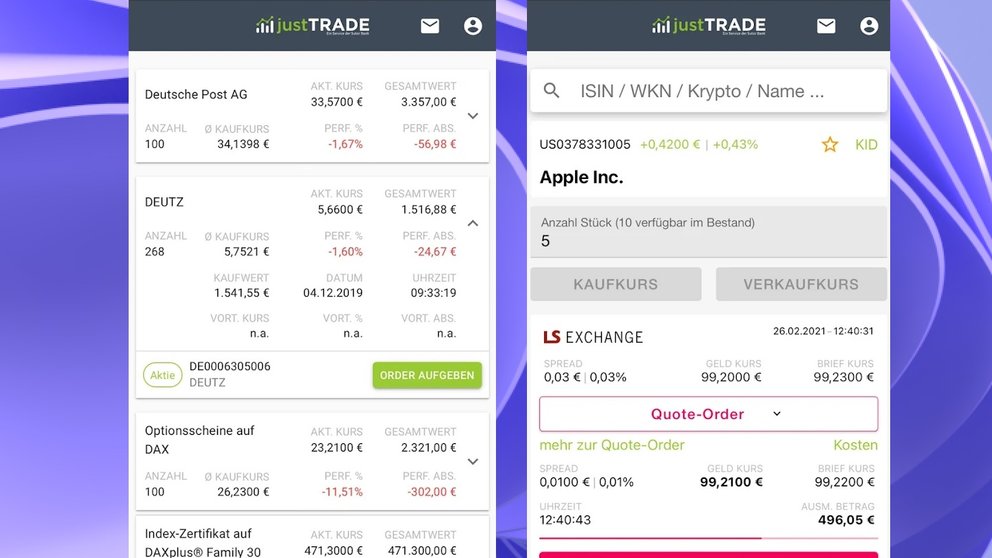

At Justtrade (to the provider) you can draw from the full, no other provider currently has so many options at the start. It should be over half a million assets, but you have to count all the certificates and warrants individually. Around 8,000 shares can be traded, as well as ETF savings plans. Minimum order size and negative interest spoil the fun.

App and entry: Justtrade is designed as simply as a neo-broker could be. Get the app, create a customer account, verify using the video identification process and link the account. To buy shares, you now have to transfer money to the docked account, this is only possible via SEPA transfer. Offer and prices: The offer is very large, Justtrade offers three stock exchanges to choose from: LS Exchange, Quotrix and Tradegate Exchange. This is useful for price comparison. There are no order commissions, nor are there any custody fees, flat-rate fees for third-party costs or trading venue fees. However, there is a minimum order volume of 500 euros. So if you "only" want to invest 100 euros, you can't do that at Justtrade. ETF savings plans, which can be used from as little as 25 euros per month, are quite new. Caution, under certain circumstances negative interest may also fall on the docked clearing account. If there are more than 5,000 euros, 0.5 percent are due. Special features and extras: Due to the minimum order volume, real small investors are left out at Justtrade. ETF savings plans are new and the supply is likely to grow in the near future.Conclusion: Large selection, different stock exchanges and manageable fees, Justtrade is not a bad choice. However, you must be able to manage at least 500 euros per order and make sure that there is not too much money in the clearing account, otherwise there is a risk of negative interest.

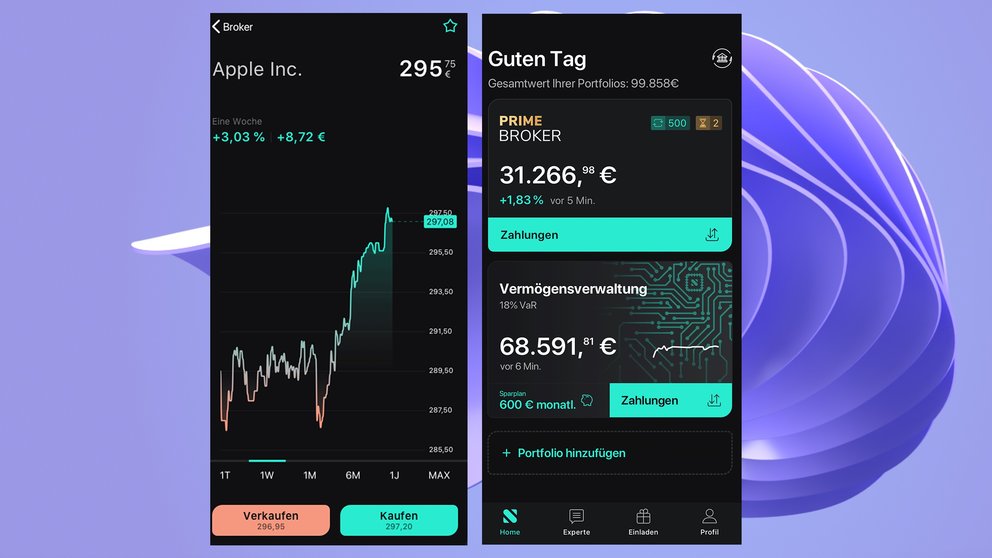

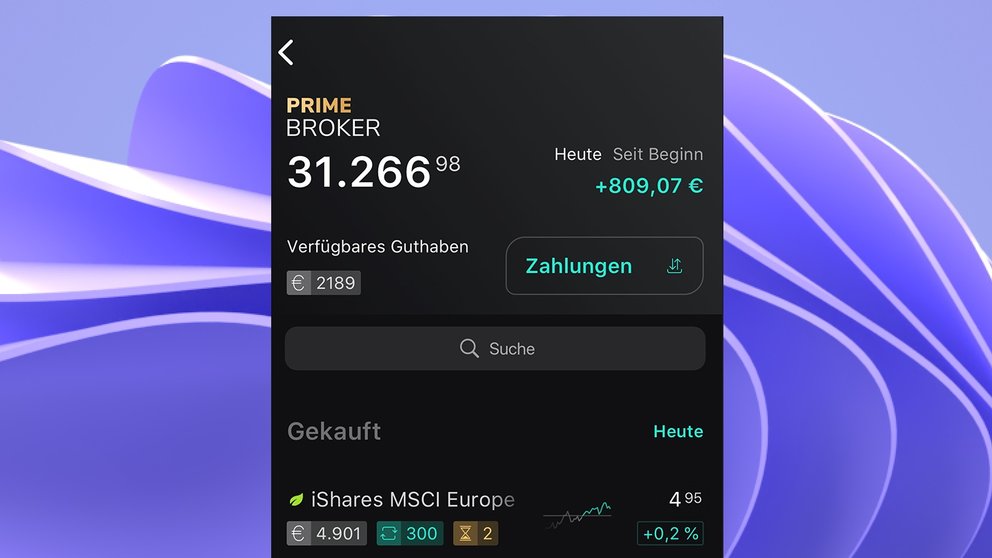

Scalable Capital Free Broker: With Xetra connection

Scalable Capital (see offer) was founded in 2014 but has only been active as a broker since 2020. Nevertheless, the Munich-based company has ambitious goals: They want to become Europe's leading digital investment platform.

App and entry: The app bundles stocks, ETFs, derivatives, funds and cryptocurrencies under one hood. Getting started is very easy after loading the app, just register, verify via video ID and then connect a SEPA-enabled account. By bank transfer you deposit money that you can trade with. Offer and prices: Scalable Capital is active as a financial service provider in several areas. A free broker account is sufficient to get started. Still good to know: With the Alternative Prime Broker, experienced users get a trading flat rate. But it costs 35.88 euros a year for a depot fee. Free Broker, on the other hand, is free. There are no negative interest rates, ETF savings plans can be used free of charge from 1 euro. The order fees are a bit more complex, there is no minimum order size, but only from 250 euros there are no transaction costs at Gettex, below that it is 99 cents per trade. Xetra orders, on the other hand, cost EUR 3.50 plus 0.01 percent of the order volume. Special features and extras: Scalable Capital is the only one of the smartphone brokers presented that also offers Xetra trading and the app is really very well made.Conclusion: If you want Xetra, you have to opt for Scalable Capital, trading with Gettex works more cheaply. Users can therefore choose from two trading venues.

Trade Republic: 1 euro per order

Trade Republic (on sale) is very popular and has over a million customers in different countries who of course can't all be wrong. Nevertheless, the provider wants to continue to grow and open up even more countries.

App and getting started: One reason why Trade Republic has so many users is that it is easy to use. In a few minutes you have installed the app and created an account. You still have to verify yourself via video identification, after which you can deposit money via SEPA transfer. Alternatively, a deposit by credit card or, depending on the mobile phone operating system, Apple Pay or Google Pay also works. Offer and prices: At Trade Republic you have a good selection of around 7,500 stocks and 1,500 ETFs. There are no depot fees, you pay 1 euro per order. You can also use a good selection of free ETF savings plans, there is no lower limit for orders. Here you can also get started with a small budget. Special features and extras: The app makes you want to click your tongue, for example there are regular news for everyone who wants to deal more intensively with stocks. But that is not a must. There are also cryptos, where the range was recently increased from 7 to 30 currencies.Conclusion: low budget? No problem with Trade Republic. There is a large selection of stocks and ETFs, the order fee of 1 euro is bearable, and ETF savings plans are free. Unfortunately there is only one trading place, experienced users can use it as a second depot.

Get started with trading apps

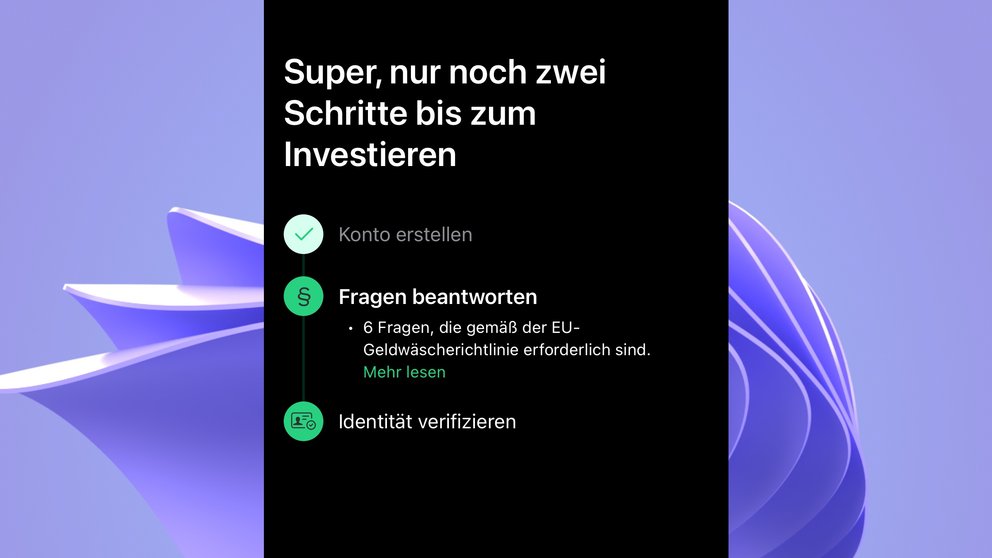

It has never been so easy to trade on the stock exchange. With their low costs, the trading apps also open up the stock market for very small investors. All you have to do is download one of the apps and open an account. This requires a few personal data, then it goes on to a video identification, which is required by law.

It all works on the cell phone and if you have managed to hold your ID relatively wobble-free in the camera, you are almost done. Before you can buy shares and funds, you still have to pay in money, which is usually done by SEPA transfer. A standing order is suitable for savings plans. As soon as the transfer has arrived, usually after one to three days, you can start.

Trading apps in practice

The apps work with fixed trading platforms, such as Gettex, LS Exchange or Xetra. Some apps such as Bitpanda, Trade Republic and Finanzen.net do not offer a selection, there is only one stock exchange. Others integrate several stock exchanges, but this should not be particularly important for newcomers to stock trading.

You should buy well-known stocks and common ETFs during normal trading hours, i.e. from Monday to Friday from 9 a.m. to 5:30 p.m. Then you are safe from excessive price ranges.

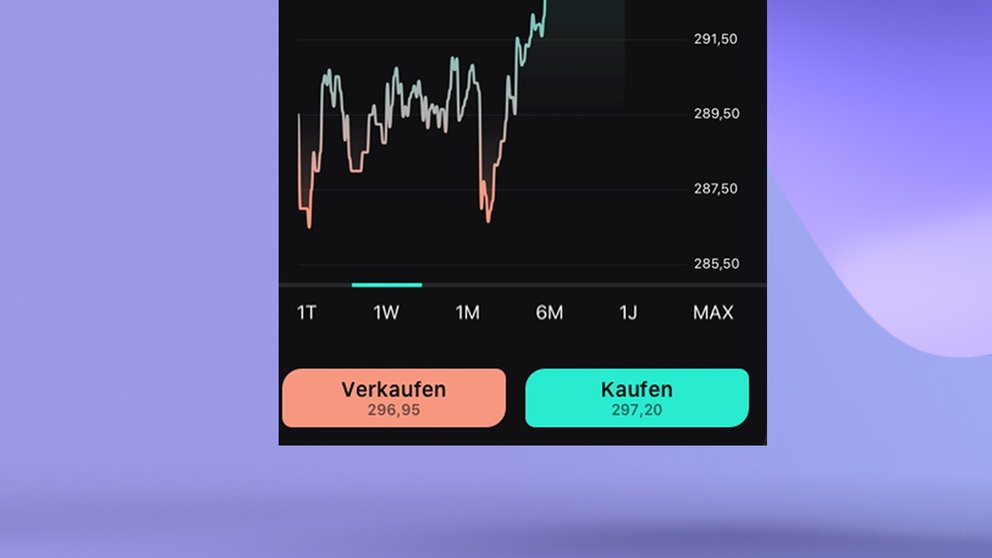

Beware of price ranges, understand spreads

Stock trading completely free, how can that work? First of all, "completely free" is not correct, because there are often small costs even with neo-brokers. These are, for example, order fees if a certain volume is not reached or negative interest on the connected clearing accounts. Nevertheless, the whole thing is very cheap.

If you invest in shares, you will also be asked to pay elsewhere, namely when buying and selling a so-called trading margin, the spread. This is the difference between the buy and sell price of the shares. The spread is often also described as the difference between the ask and bid price or called the bid-ask spread. The spread is usually lower during trading hours.

Advantages of trading apps

Fast start: The desire to invest money has often come up, but you couldn't deal with it for more than five minutes? That's enough to start the apps including registration and verification. Then you only have to take the last hurdle and deposit money into a clearing account. Ease of Use: Beyond setup, trading apps are easy to use. You can usually follow the courses and buy and sell with a few taps. Low costs: None of the new providers charge custody fees anymore, which seems to be a red rag for investors. There is also rarely an order fee for buying securities and savings plans, and if so, it is manageable. But you can't trade for nothing (see disadvantages). Around the clock: Neobrokers also let you trade outside of normal trading hours. But be careful, you should be particularly careful here (see disadvantages).Disadvantages of trading apps

Few stock exchanges: Neobrokers often only offer one stock exchange. Then users cannot compare and have to deal with the spreads that are offered when trading. Restricted order types: Not all order types are always available for every trading venue, which can then restrict advanced investors in particular. If you want to work with limit, stop-loss or stop-loss limit orders, you should check whether the neobrokers allow this. Cost traps : Big scandals have not yet become public for the apps presented, but you can also run into cost traps with neo-brokers. You should therefore always pay close attention to the spread in order not to pay too high trading fees. Trading outside of normal hours also harbors the risk of large margins of action.Trading apps demo

The providers know exactly that once the users have gone through a verification, they're screwed. That's why it's usually at the very beginning. Of course, this is required by law, but what you could do would be a demo mode for the apps, preferably with play money. The provider Bison does this, for example, with crypto money. Then you could immediately try out whether everything works the way you imagine it. Unfortunately, none of the neobrokers presented here make this effort.

Are trading apps really completely free?

No. Even if you often read "0 euros" and "free" in the app descriptions and on the websites – stock trading is not completely free and of course it can't be. A trading app is complex to make, it has to be safe and fast, it has to meet high legal hurdles and it has to be easy to use. There are no custody fees, the order fees are often 0 or 1 euro and you can also invest small monthly amounts in ETF savings plans without surcharges.

In any case, the trading margin, the so-called spread, is paid for. This is common in stock trading and means the spread between the buy and sell price. This is how the exchange partners earn money in the background and they in turn give reimbursements to the neobrokers. What you should know: This is at least one business model that the Bafin is observing.

Can I also trade cryptocurrencies with the trading apps?

Yes, it works, although there are differences here too. We also recently looked at crypto trading apps, but the neobrokers presented here also allow you to invest in Bitcoin & Co. Of course you can do that, but there are worlds between investing in an ETF and cryptocurrencies.

For a few months we have been running a small test with 50,000 euros of play money that we have put into different cryptocurrencies. Our crypto money is currently worth around 30,000 euros, so we are deeply in the red. But with play money you can easily endure it.

Trading apps - test winner?

The Stiftung Warentest is now also looking at Neobroker, but a test winner has not yet been chosen there either. The background is that the previous test procedure is tailored to online brokers, who usually have many more trading places. Neobrokers don't fit in there because they often only integrate one stock exchange. So there is currently no Neobroker test winner.

Trading Apps – Taxes?

The state also wants to earn money from stock transactions, so the so-called final withholding tax is due. This is automatically paid to the tax office by most neo-brokers or the bank that manages the clearing account. This is the case with the presented trading apps based in Germany, only with Bitpanda do you have to take care of the correct taxation yourself.

Trading Apps Stocks or ETFs

We're not giving any investment tips here, but there is a fundamental difference between investing in stocks and ETFs. Of course, as iPhone fans, you can buy the expensive Apple shares, and if you succeed in bringing exciting products onto the market in the future, then the prices will also rise. But those who rely on individual stocks naturally have a greater risk.

This decreases if you diversify more widely, i.e. hold 15 or 20 different shares, which is time-consuming and requires more capital. Here you end up very quickly with funds and the ETFs are based on various stock indices. So you invest in many companies at once. Some stocks go down, some go up, but the bottom line is there is growth that you take with you.

Trading Apps Privacy Policy

Of course, security and data protection must also fit with neobrokers, after all, your money is in the services. The Bafin regulates the German providers, in the case of Bitpanda it is the Austrian financial supervisory authority. The user accounts must all be verified by ID card, otherwise password and SMS access codes are the common features.

Here you could definitely expand a little, whereby the payouts are always linked to the deposited account. Justtrade excels when it comes to data protection. The app does not integrate any known tracker, while Bitpanda has eight. As in other apps, there are many Google interfaces. Bitpanda also stands out negatively when it comes to permissions, the app requires up to 23 permissions, with Finanz.net Zero there are only nine.

Trading Apps: Reviews

The ratings in the app stores should always be treated with caution, a bad release can sometimes trigger a clean shitstorm. Apps that, on the other hand, update rarely but solidly often come out with strong ratings.

Trading App Note in Apple AppStore Note in Google PlayStore Bitpanda 4.8 4.3 Finanzen.net Zero 5.0 3.1 Justtrade 2.8 2.9 Scalable Capital Free Broker 4.5 4.3 Trade Republic 4.2 4.15 survival tips for stock trading with neo-brokers

At this point we will not recommend any stocks or special ETFs. You have to make your own decisions about where to invest your money. Firstly, there are far better experts than us and secondly, there is of course always a risk when investing. However, we would like to give you a few tips if you are new to stock trading and use one of the neo-brokers:

No false expectations: Comparisons are always bad and lead to frustration. Who wouldn't have liked to get into Bitcoin with their savings right from the start, or who wouldn't have liked to invest in Apple shares when everyone was saying the Apple company was dead. The fact is, you're always smarter with hindsight. Yes, you can get rich in the stock market, but just because you put $25 a month into an ETF savings plan doesn't make you Elon Musk. However, the majority of investors can increase their own money with a good strategy and you can escape the loss of money in your account. No acts of desperation: You haven't invested your money anywhere in the last 20 years, then you can wait a few minutes. Don't let the apps force you into anything, you can pump a lot of money into them with little effort. Rather compare the prices, look at the fees listed and only make the decision when you are convinced that this is the right thing. Start small: If you don't have a lot of money left over at the end of the month, you can't invest much anyway. The neobrokers are then a good choice. But if you already have a little more money on the high edge, you should still start small. How come? First try a small savings plan to see if the whole Neobroker thing works for you. Make a plan to put $100 a month into an ETF for 1 year, for example. The year goes by faster than you think. Then see what happened to the 1,200 euros. Stay cool: Of course there are users who are very experienced and know exactly when to buy and sell what. For Otto-Normal ETF savings planners, however, the motto can only be to first make a plan, then invest the money and then stay cool for a long time. You have to sit out crises, because they always exist. This is currently more visible to us in Germany than usual with the Ukraine war and Corona, but there is always a crisis in the world and that affects the financial markets. Get rid of the smartphone: Just because you can always track everything in the apps doesn't mean that it makes sense. If finances are your hobby, then fire away, but for normal people it means investing and then away with the smartphone. Turn off notifications from the apps and only check in from time to time, but don't let them drive you crazy. Go through with the plan once you've made it, check the results and then make adjustments if necessary. Those who invest in stocks can reconsider the mix after a year, ETF investors can sit back, relax and pursue other hobbies.

I prefer high-quality content, which I discovered in your article. The information you've provided is useful and important to us Capital trading scam. Continue to post articles like these. Thank you very much.

ReplyDelete