o2 starts catching up: Even Telekom can t keep up

Telekom, o2 and Vodafone are fighting for supremacy among German consumers. As a rule, Telekom is ahead of the game. But o2 has had a really good year. The almost eternal third party can even beat Telekom.

o2 is growing faster than Telekom – Vodafone has to be content with third place

Vodafone, Telekom and o2 not only share large parts of the German mobile communications market among themselves as network operators, but also as providers with their own tariffs, the three major providers gather many customers under their respective brands.

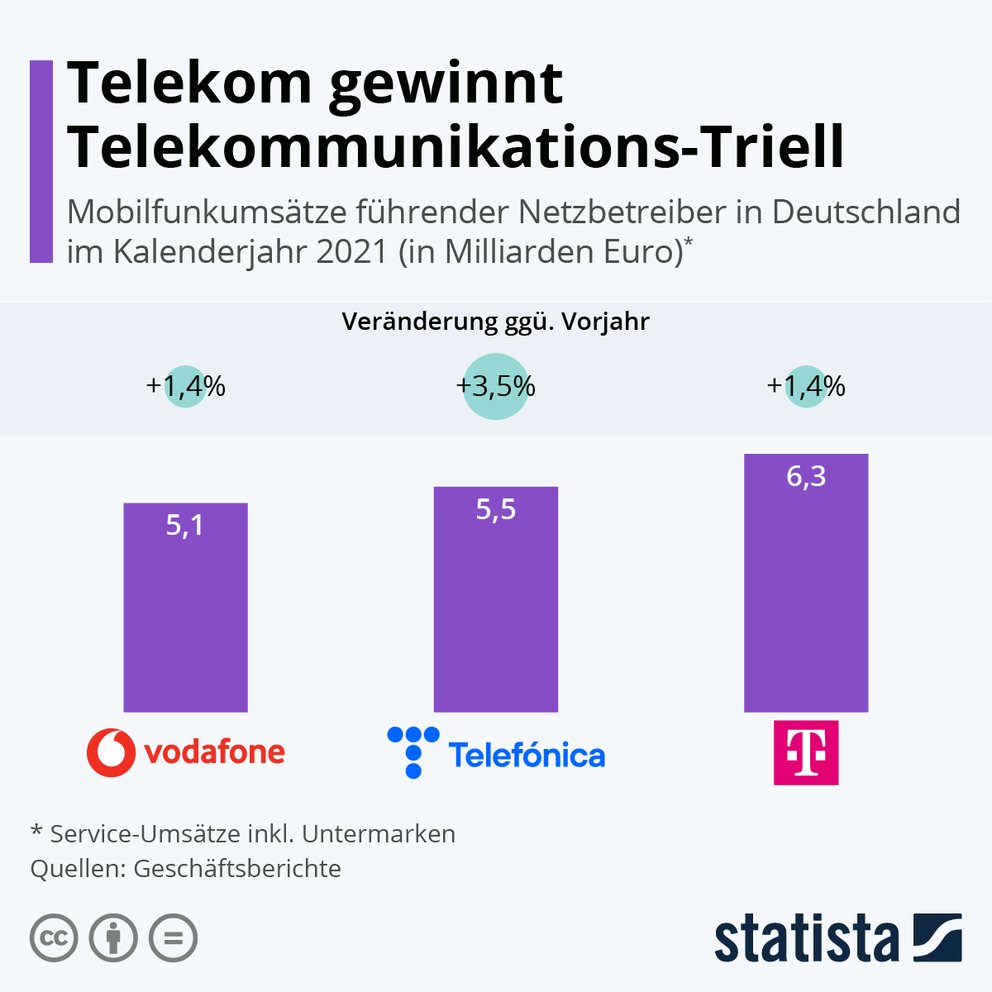

This has not changed in 2021 either, but something is happening in the weighting between the competitors. Although Telekom is still the clear market leader, o2 is clearly increasing in sales growth - and even overtaking Telekom. While Vodafone and Telekom were both able to increase their revenues from the mobile phone business by 1.4 percent in a year-on-year comparison, o2 managed an increase of 3.5 percent. According to the Federal Network Agency, Telefónica/o2 welcomed around 1.5 million new customers last year (source: Statista).

In total figures, however, Telekom continues to lead: the market leader generated 6.3 billion euros in the 2021 calendar year in the mobile communications segment alone. A test had recently attested o2 a quality advantage over Vodafone, which placed the brand in second place after a long time. Elsewhere, Vodafone was still in second place. But the numbers show: o2 ends up with 5.5 billion euros in sales ahead of the competition from Düsseldorf with 5.1 billion:

o2 aims to close the gap: 2022 will be an important year

According to Statista , o2 could close the gap to the market leader Telekom even further this year. Included in the calculations are not only the sales of the core brands. Other brands are also included, such as Blau (Telefónica/o2), Congstar (Telekom) or SIMon mobile (Vodafone).

Our smartphone recommendations from the entry-level class:

However, the positive development of o2 shows one thing above all: the days when o2 was considered the worst alternative nationwide seem to be finally over. Indeed, if the provider continues this trend, further catching up becomes more and more likely. It remains to be hoped that o2 will continue to invest the additional income in a better offer.

Comments

Post a Comment